|

|

|

|

Forum...My Say

Feedback from

The EDGE's Chief Editor

arifin;

a feedback from a

reader.........perhaps your take

on the market for the rest of

the year. seems to be heading

950 and above where does oil

prices fits into this. can do a

market/plus oil RT special.

salam |

|

|

|

hi che leng.

we will 4ward yr request to

ariffin. the market as measured

by KLCI has been quite upbeat.

but guess yr clients want to

know abt the second and third

liners rather than klci stocks,

right?

tks

p/s

-----

Original Message -----

From: Tan Che Leng

To:

hktat@bizedge.com

Sent: Saturday, August

13, 2005 2:54 PM

Subject: Article on

market trends

Hi Mr Ho, I am Leanne from HLG Securities Sdn Bhd. I have been an EDGE

subscriber thru my company since

many years ago. I remembered

that EDGE did have several

articles about KLSE overall

market trend by one malay guy by

the last name of Ariffin. I just

can't remember the full name.

Since the market has been in the

doldrum for so many yrs since

the technology market

burst in 2000, it might help us

to shed some lights on the

timing on when the market will

come alive again. It would be

nice to have him to write an

article on the market direction

again. I remember the last

article by him was on oil

prices. Many clients who have

been holding on second/third

liners are waiting seems to be

endless yrs for their counters

to recover. He talks

about the three inverted Buddhas

so I remembered, people are

always looking for some sheds of

light when we are still in the

dark. I can be reached at TCL@HLG.COM.MY.

Thks. |

|

|

|

|

|

|

|

|

My Say: Is US$60

a barrel here to stay?

By Arifin

Abdul Latif |

|

Surging world oil prices are the norm

nowadays, irrespective of whether one wants to

believe that speculative mania is at play.

Today, our economic masters are pointing their

fingers at speculators. Last year, Saudi

Arabia's Oil Minister Ali Naimi was quoted as

saying he did not believe oil prices would ever

reach US$60 a barrel. He said the burgeoning

influence on world oil prices from a new breed

of investors had weakened the muscle of the

Organisation of Petroleum Exporting Countries

(Opec).

"US$60 oil is here. Oil prices hit

that milestone for the first time [during

intra-trade trading] Thursday (June 23, 2005),

as the bullish frenzy that has gripped the

market for months deepened," FWN Financial News

reported.

Alas, my forecast published in the

article "Flirting with US$60 barrier?" (Issue

513, Aug 30, 2004) has materialised. No doubt,

prices will retreat, as profit-taking activities

seep into the pits of the New York Mercantile

Exchange (Nymex). That's part and parcel of

being in the marketplace — for whatever

commodity. But now, the pundits are toying with

new targets of US$70, and even US$100 per

barrel. Lest we forget, Goldman Sachs warned of

a superspike of US$105 crude! It may not happen

so soon (see my article "Oil for thought", Issue

544, April 11, 2005). It took about 10 months

for crude oil price to breach my earlier

forecast of US$60 per barrel. Will the price

remain at that level, retreat or surge ahead?

I believe for certain that speculation is

not the only culprit in the crude oil equation.

As I have argued before, among other factors,

"anything can happen under the Pax Americana

agenda". Is it pure coincidence that oil finally

breaks past the US$60 barrier for the first time

with news of Iran's President-elect, Mahmoud

Ahmedinejad, being a conservative or even a

hardliner?

Apparently, the market knows best

the potential expectations on the geopolitical

front. It happened during Gulf War I, as told

vividly by Ron Insana, CNBC's popular financial

anchor, in his book The Message of the Markets.

Is it bound to happen again — a prelude to

another heightened Iran-US confrontation that

may lead to a conflict? Classified information

does leak out as we have seen in many Hollywood

movies, and in the real world, "Deep Throat"

(though it's not oil-related) was a case in

point. Perhaps it's not an exaggeration to imply

that aside from crude/refined oil supplies and

inventories, information of such classified

nature may have its hand in the pits of Nymex,

Chicago Board of Trade and other financial

Meccas.

The global crude oil market is like

a roller coaster with a powerful force brokering

behind the scenes. Whenever a new high,

supposedly pushed by speculators (with or

without insider information), is reached, Saudi

Arabia, a major Opec producer, normally issues a

reassuring statement with or without "pressure",

primarily from its staunchest ally — the US.

Light sweet crude on June 23, 2005, touched an

intra-day high of US$60.02 per barrel on the

Nymex, but ended with a settlement price of just

below US$60. Opec's reassurance of pumping more

oil did the trick. But that was a lull before a

gathering storm, and so, it faltered again,

presumably due to fears that refiners are

struggling to keep up with demand for the second

half of the year.

The next day, crude oil

for July delivery on the Nymex hit just slightly

below US$60 per barrel. But crude oil for the

following month to July 2006 delivery ranged

from an intra-day low of US$60.10 (for August

delivery) to an intra-day high of US$62.35 (for

December delivery). These indicate fear of

pent-up demand for the third and fourth quarter

of this year. But do expect profit-taking to

resurface along the way.

What's next?

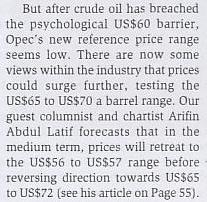

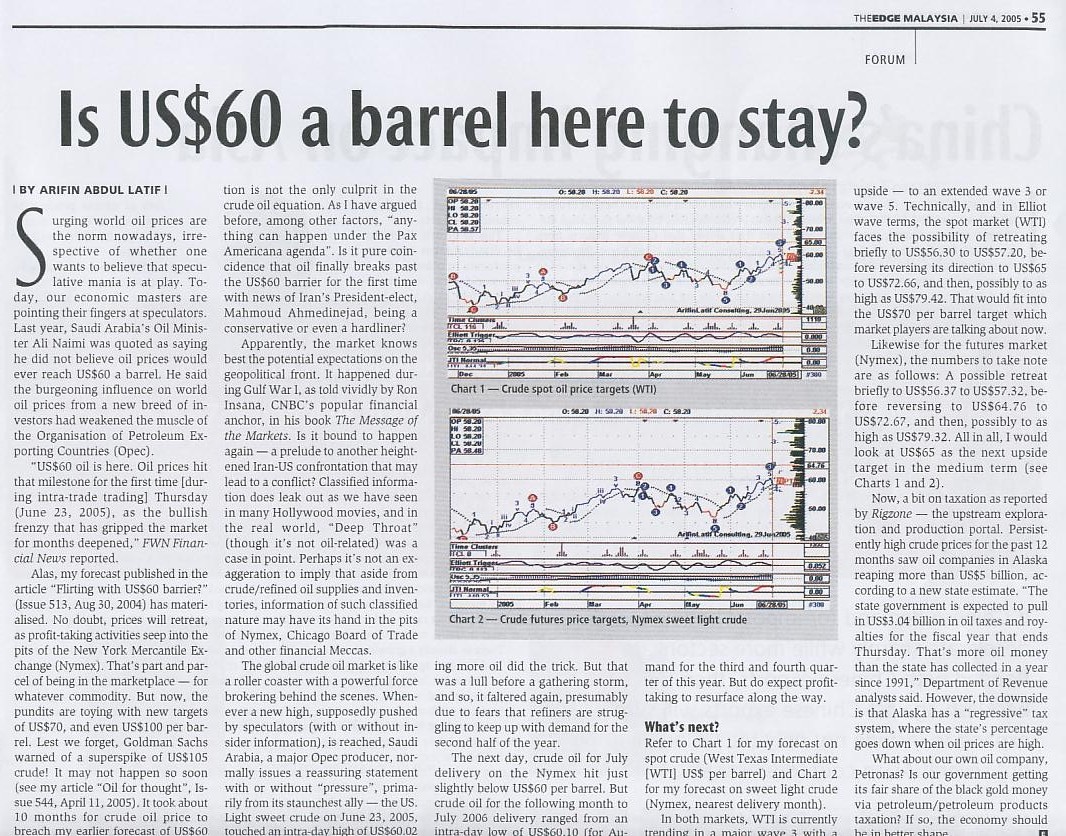

Refer to Chart 1 for my forecast

on spot crude (West Texas Intermediate [WTI] US$

per barrel) and Chart 2 for my forecast on sweet

light crude (Nymex, nearest delivery month).

In both markets, WTI is currently trending

in a major wave 3 with a slight correction bias

to wave 4. However, a 78% profit-taking index

(PTI) indicates a strong bias towards further

upside — to an extended wave 3 or wave 5.

Technically, and in Elliot wave terms, the spot

market (WTI) faces the possibility of retreating

briefly to US$56.30 to US$57.20, before

reversing its direction to US$65 to US$72.66,

and then, possibly to as high as US$79.42. That

would fit into the US$70 per barrel target which

market players are talking about now.

Likewise for the futures market (Nymex), the

numbers to take note are as follows: A possible

retreat briefly to US$56.37 to US$57.32, before

reversing to US$64.76 to US$72.67, and then,

possibly to as high as US$79.32. All in all, I

would look at US$65 as the next upside target in

the medium term.

Now, a bit on taxation as

reported by Rigzone — the upstream exploration

and production portal. Persistently high crude

prices for the past 12 months saw oil companies

in Alaska reaping more than US$5 billion,

according to a new state estimate. "The state

government is expected to pull in US$3.04

billion in oil taxes and royalties for the

fiscal year that ends Thursday. That's more oil

money than the state has collected in a year

since 1991," Department of Revenue analysts

said. However, the downside is that Alaska has a

"regressive" tax system, where the state's

percentage goes down when oil prices are high.

What about our own oil company, Petronas? Is

our government getting its fair share of the

black gold money via petroleum/petroleum

products taxation? If so, the economy should be

in better shape.

Arifin Abdul Latif is an

economic chartist based in Kuala Lumpur |

|

|

|

|

| |